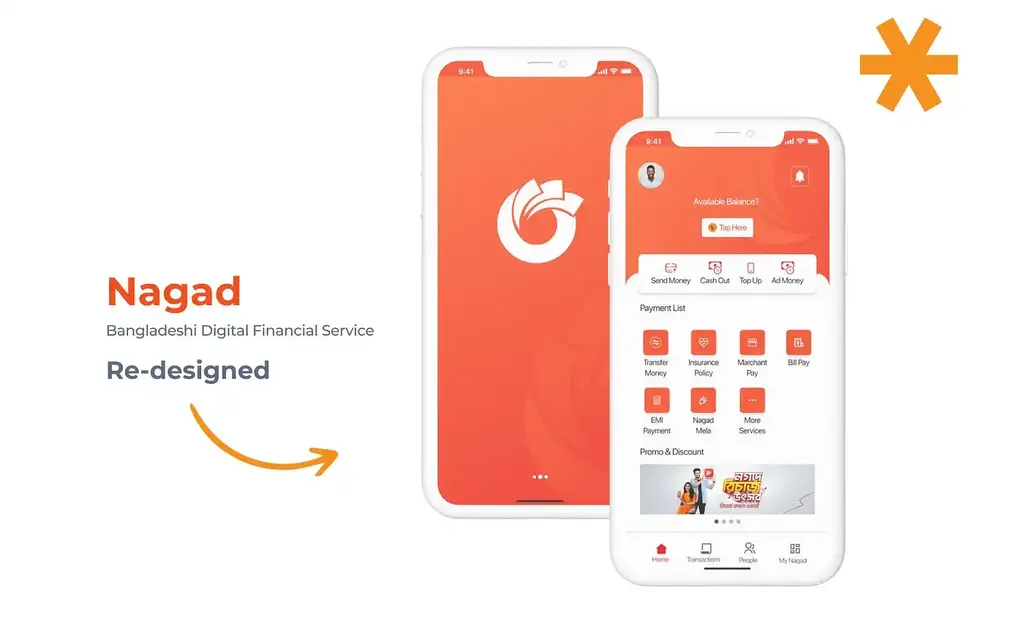

Exploring Nagad: A Comprehensive Guide

Nagad is a pioneering digital financial service provided by the Bangladesh Post Office, designed to make daily financial transactions more secure and convenient. This platform serves as an updated version of the Postal Cash Card and Electronic Money Transfer System (EMTS), reflecting the ongoing evolution of financial technology in Bangladesh. As digital financial services become increasingly integral to our lives, understanding the features and benefits of Nagad can help users navigate this essential tool effectively.

What is Nagad?

Nagad represents a significant advancement in the realm of digital financial services, offering a secure app tailored to the needs of users in Bangladesh. As a service of the Bangladesh Post Office, it builds on the legacy of the Postal Cash Card and EMTS, providing users with enhanced functionalities and a seamless experience. The Nagad app is designed to facilitate a wide range of daily financial transactions, from money transfers to bill payments, catering to the diverse financial needs of its users.

The importance of digital financial services cannot be overstated in today’s fast-paced world. They offer unparalleled convenience, allowing users to manage their finances from the comfort of their homes or on the go. Nagad stands out by combining the reliability of the Bangladesh Post Office with modern digital solutions, making it a trusted choice for many.

- Secure transactions with a PIN number for login

- Convenient mobile recharge options

- Easy payment of postpaid mobile bills

- Detailed transaction history for better financial management

- Virtual card system for streamlined transactions

With these features, Nagad not only simplifies financial transactions but also ensures a high level of security and user satisfaction. This makes it an indispensable tool for anyone looking to manage their finances efficiently.

Overview of Nagad’s Digital Financial Service

Nagad88 is a digital financial service offered by the Bangladesh Post Office, providing a secure and efficient app for managing daily financial transactions. This service is a modern iteration of the previously introduced Postal Cash Card and EMTS, reflecting the continuous effort of the Bangladesh Post Office to meet customer needs with innovative services.

The role of digital financial services has grown significantly in modern times, becoming a cornerstone of financial management for individuals and businesses alike. Nagad 88 exemplifies this trend, offering a comprehensive suite of features designed to simplify and secure financial transactions. From sending money to paying utility bills, Nagad provides users with a reliable and user-friendly platform.

- Cash in and cash out services at Uddokta points

- Money transfers to other Nagad users

- Mobile recharge for all major mobile network operators

- Postpaid bill payments for mobile services

- Access to detailed transaction history and monthly summaries

These features highlight the versatility and utility of the Nagad app, making it an essential tool for managing everyday financial tasks. Whether you need to recharge your mobile, send money to a friend, or pay a bill, Nagad provides a secure and convenient solution.

Features and Benefits

The Nagad app offers a range of features that cater to the diverse needs of its users. One of the key benefits is the ability to manage your digital financial service account with ease. The app provides detailed transaction history and monthly transaction summaries, allowing users to exert greater control over their finances. Additionally, users receive notifications for their latest Nagad transactions, ensuring they stay updated on their account activity.

Checking your balance has never been easier with the one tap balance check feature. This allows users to quickly and conveniently view their account balance without navigating through multiple screens. The app also supports payment of postpaid mobile bills for all major mobile network operators in Bangladesh, including Robi, Airtel, Teletalk, Grameenphone, and Banglalink. This feature simplifies the process of paying your mobile bills, saving you time and effort.

- Receive notifications for latest transactions

- One tap balance check for quick balance updates

- Pay postpaid mobile bills effortlessly

- Recharge mobile phones with ease

- Detailed transaction history and monthly summaries

The virtual card system is another notable feature of the Nagad app. This system allows users to conduct transactions seamlessly, adding an extra layer of convenience. However, users may have questions about the card’s capabilities, such as whether it can be used for other currencies or for receiving and transferring money like a traditional bank account. These aspects highlight the app’s potential and the need for further clarity on its functionalities.

User Experience

Nagad offers a mixed user experience, with several pros and cons. On the positive side, the app facilitates essential daily financial transactions such as cash in, cash out, peer-to-peer money transfers, and mobile recharges. These functionalities make it a valuable tool for users seeking to manage their finances efficiently. However, some users have pointed out the need for enhanced functionality and interactivity within the app.

User feedback and ratings provide valuable insights into the app’s performance. With 1.3K ratings and an average rating of 3.4, the Nagad app has received mixed reviews. While some users praise the virtual card system and the ease of transactions, others have reported errors and dissatisfaction with certain aspects of the app. This feedback underscores the importance of continuous improvement and responsiveness to user needs.

- Facilitates essential financial transactions

- Mixed reviews with an average rating of 3.4

- Positive feedback on the virtual card system

- Reports of errors and dissatisfaction

- Need for enhanced functionality and interactivity

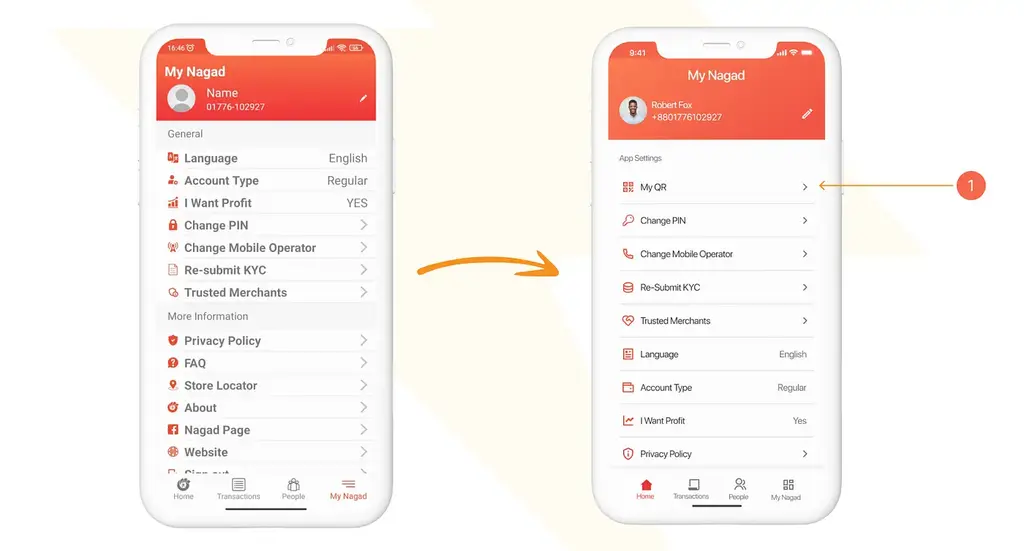

Areas for improvement include making the app more user-friendly and enhancing its overall design and aesthetics. A focus on these aspects can help create a better impression for new users and improve the overall user experience. By addressing these issues, the Nagad app can continue to evolve and meet the growing demands of its user base.

Security and Data Privacy

Security and data privacy are paramount when it comes to digital financial services, and the Nagad app is no exception. The app requires users to provide a PIN number for login and transactions, ensuring that all activities are secure. This security measure is a fundamental aspect of the app, providing users with peace of mind as they conduct their financial transactions.

Data protection measures are in place to safeguard user information. The app may use data to track users across different apps and websites owned by other companies, which raises important considerations for user privacy. It is crucial for users to be aware of these practices and understand how their data is being used.

- Requires a PIN number for secure login and transactions

- Data tracking across apps and websites

- Collection of data linked to user identity

- Data not linked to identity is also collected

- Ensures secure transactions and data storage

Ensuring secure transactions and data storage is a top priority for the Nagad app. Users can trust that their financial information is protected, but it is also important to stay informed about data privacy policies. This balance between security and transparency is essential for building and maintaining user trust.

Conclusion

Nagad offers a robust digital financial service platform that provides users with a secure and convenient way to manage their daily financial transactions. The app’s features, such as mobile recharge, postpaid mobile bill payments, and a detailed transaction history, make it a valuable tool for users. However, there is always room for improvement, particularly in terms of user experience and functionality.

For users looking for a reliable digital financial service in Bangladesh, Nagad 88 is a strong contender. Its secure app, backed by the Bangladesh Post Office, ensures that users can conduct their transactions with confidence. As the platform continues to evolve, addressing areas for improvement will be key to maintaining its position as a leading digital financial service.

FAQ

Nagad is a digital financial service offered by the Bangladesh Post Office, providing a secure app for daily financial transactions.